As the online personal finance world grows, we’re starting to see some very interesting opportunities for investors. I recently received an email from a company with a business proposition that is different from what I typically review but found myself interested in their business proposition and marketplace niche. The company is Wunder Capital Investing. I wrote a short executive summary and then turned over some space to Ilyas Frenkel at Wunder Capital.

Wunder Capital Investing Review

Executive Summary

Wunder Capital is an online investment platform for the Solar Energy market. Accredited investors can invest in two different solar funds:

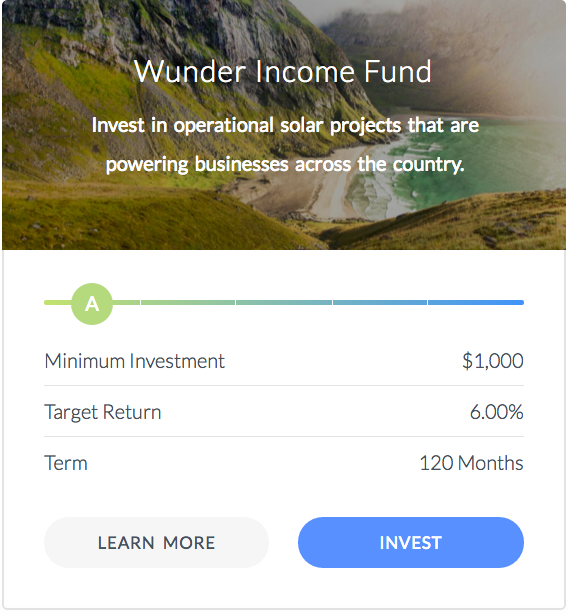

Wunder Income Fund – Target Return of 6%

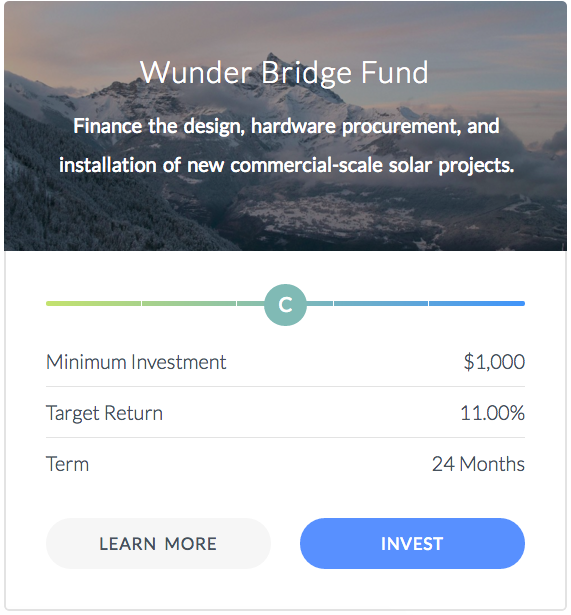

Wunder Bridge Fund – Target Return of 11%

Minimum Investment is $1,000.

Investment terms are 2 years or 10 years.

No investment fees.

Wunder Capital is an investing company and a solar energy company. Your investments in Wunder go directly to solar energy projects across the country. As those projects are built your investment is having a direct positive impact on the environment and helping to combat global climate change.

(Wunder 60 second explanatory video)

Detailed Review from Ilyas at Wunder Capital

This review will dive into what exactly makes Wunder Capital unique in the marketplace. We’ll touch on some important factors that have made Wunder Capital successful. We’ll also dive into a detailed discussion of Wunder’s two solar funds.

—

What is Wunder Capital?

Wunder Capital is a financial technology company that provides financing to solar projects throughout the country. Based in Boulder, Colorado, Wunder allows accredited individuals, trusts, family offices, foundations, hedge funds and pension funds to invest in the country’s new solar infrastructure. Wunder was founded in 2013 and won the U.S. Department of Energy’s 2014 Sunshot Challenge, the COSEIA’s 2015 Summit Award and was the first solar technology company to complete the Techstars technology accelerator program. Wunder’s software-based approach is dedicated to removing logistical barriers and cost to solar investing, passing the savings on to investors.

—

How Does Wunder Capital Work?

Wunder works with solar installers, developers, and distributors across the country to source strong solar projects. Once Wunder’s solar specialists have identified high quality solar projects in need of financing, they run the loans through a rigorous underwriting and quality assurance process. Once they’ve identified an opportunity that meets their demanding standards, they negotiate the deal, handle the legal contracts, and wrap it up into a fully-managed investment fund that includes other standout investment opportunities.

Wunder Income Fund (Target Return of 6%)

Invest in a diversified portfolio of commercial solar systems that service some of the most stable businesses in the country. This solar project portfolio provides targeted monthly cashflows of 6% annually for 10 years, and it significantly reduces carbon energy pollution – aiding in the fight against climate change.

The Wunder Income Fund is a safe choice for investors looking for monthly cash-flows and a low risk investment. Unlike investing in a mutual fund, Wunder Capital won’t charge you any fees for investing your money. You’ll receive monthly cash-flows deposited directly into your bank account.

Wunder Bridge Fund (Target Return of 11%)

Wunder Bridge Fund (Target Return of 11%)

The Wunder Bridge Fund provides investors exposure to a portfolio of asset-backed commercial solar loans. These loans are provided on a project-by-project basis to commercial solar installers that Wunder has partnered with, and each loan is secured by the installer’s assets. Capital is used for new project development activities, such as system design, hardware procurement, and system installation.

The Wunder Bridge Fund is for investors who are a little more risk tolerant than investors who’d invest in the Wunder Income Fund. The fund’s target return is 11% annually over a 24 month term. Just like with the Wunder Income Fund, the Wunder Bridge Fund has no fees. You’ll receive your monthly cash-flows deposited directly into your bank account.

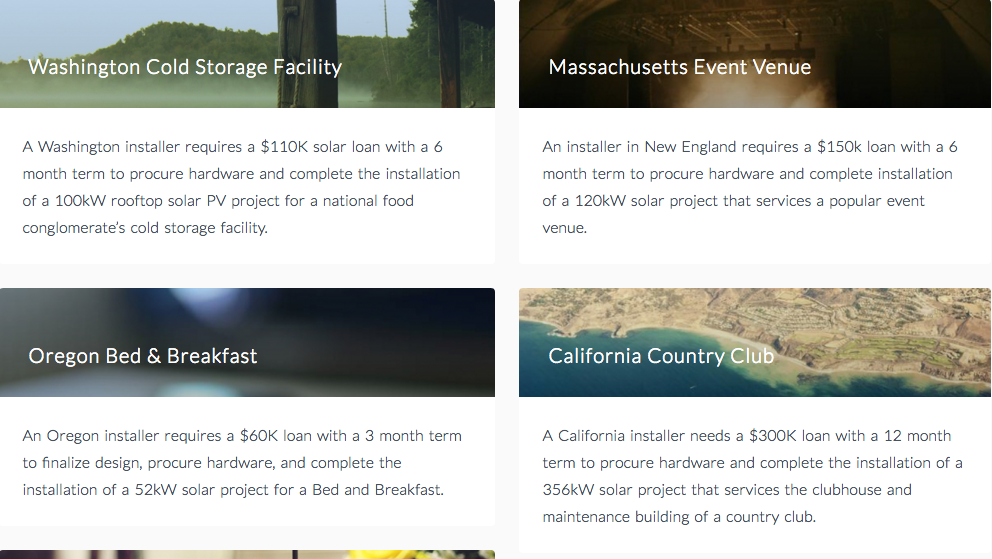

The Kinds of U.S. Businesses You’re Investing in with Wunder Capital

Who Should Consider Investing in Wunder Capital

Wunder Capital is a great investment alternative to the market. Wunder’s solar funds are asset backed so market fluctuations don’t affect your return as an investor. Your investment with Wunder goes directly to healthy U.S. businesses to help them finance solar panel installations. If you invest, your investment helps to curb pollution and reduce carbon emissions. Wunder Capital is a great fit for anyone interested in Impact Investing, Socially Responsible Investing (SRI), or someone simply looking to diversify their assets and earn a strong return.

—

See Wunder Capital’s Investment Details

Start Earning Strong Returns, While Helping the Environment!