FutureAdvisor Review Updated for 2015

What is FutureAdvisor ?

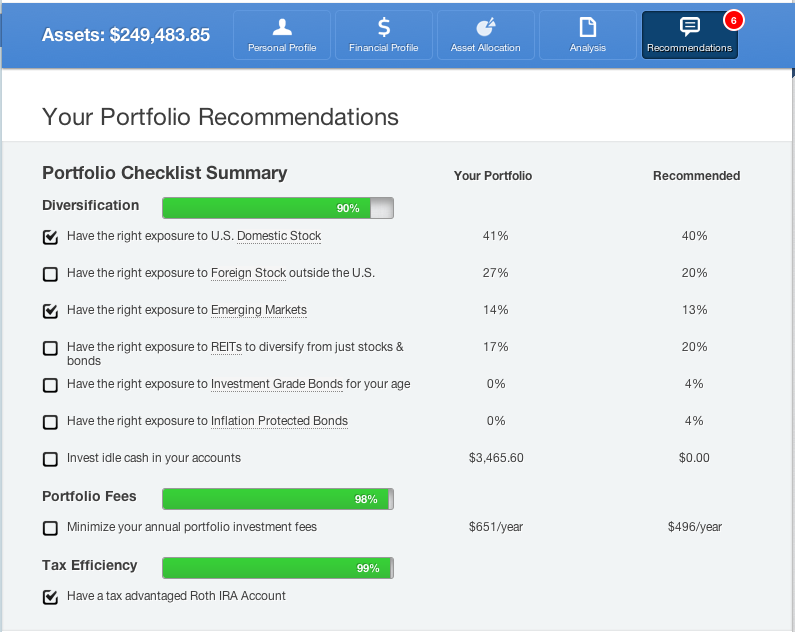

FutureAdvisor is an asset management company that aggregates all of your account information and provides you with personalized portfolio recommendations based on your risk tolerance, age, and other factors. FutureAdvisor will analyze your current asset allocation and provide you with recommended changes. For a low fee of $9/month (or $16/mo if you have assets greater than $50,000), FutureAdvisor will automatically manage your portfolio for you. The company now has assets under management of over $600 Million and features live advisors creating a technology driven platform with a human touch. You can also now manage your 529 College Savings Plan with FutureAdvisor.

How Much Does FutureAdvisor Cost?

They have two plans.

1. The free plan is a DIY version that provides you with a personalized asset allocation, fee savings opportunities, tax savings opportunities, and self-directed rebalancing alerts. FutureAdvisor currently has over 320,000 registered users who are tracking over $40 billion in assets.

2. For asset mangement, FutureAdvisor charges 0.5% of assets under management.

Asset management includes the following services:

- Personalized portfolio allocation

- Tax aware portfolio design

- Tax loss harvesting

- Rebalancing

- Email alerts regarding your investments

How Does FutureAdvisor decide what to invest in?

FutureAdvisor has a methodology based on the following tenets:

1. Index Investing – Index investing outperforms 92% of managed mutual funds. Good luck finding the 8%. I’ll stick with indexing as well.

2. Diversification – Personalized diversification and personalized risk analysis. They want you to have the same service as the wealthy so they utilize Modern Portfolio Theory to create a risk adjusted portfolio that is sufficiently diversified to allow you to capture the returns across different markets. MPT is a great way to give yourself the best odds of success.

3. Low Fees – Fees erode your returns. It sounds like a no-brainer but time and again we get caught up in a great opportunity without studying the real cost. FutureAdvisor helps you find the low fee funds.

4. Rebalance – Quarterly rebalancing helps you smooth out your returns. You lock in your gains and get back to your risk-adjusted, optimized portfolio.

5. Value and small cap – Your portfolio will tilt toward value investing and small cap investing. It’s not clear to me how much they will tilt your portfolio or how they identify the best value funds but they cite studies that show this is the best way to go.

The idea behind FutureAdvisor is similar to Wealthfront, MarketRiders, and PersonalCapital in that the company uses technology to provide world class investment advice to an underserved majority that would not normally be able to afford that level of service. By leveraging algorithms based on Modern Portfolio Theory, these company’s can significantly lower the cost of service by creating economies of scale. Thus, the cost of the advice declines and the price charged to us drops significantly.

Where MarketRiders is focused on ETFs and provides recommendations only, FutureAdvisor gives you a recommended portfolio of ETFs and low-cost Mutual Funds to get to your ideal portfolio, then will also make those trades on your behalf. One of the really great features is that FutureAdvisor will help you find opportunities with your existing portfolio, advising you to move to funds with lower fees based on their analysis of your holdings. Fees erode long-term returns and it makes little sense to hold onto high cost funds when better alternatives are presented. They also have relationships with certain company’s so that you can have your 401(k) analyzed. It’s a nice feature if you are among the lucky few.

Is FutureAdvisor Safe?

FutureAdvisor utilizes bank level security to ensure that your money is safe. This means 256-bit encryption. Furthermore, FutureAdvisor utilizes the same account aggregation software as Mint.com. For their free plan, they make recommendations and count on you to enact those recommendations on your own.

For the premium plan, FutureAdvisor transfers your accounts to TD Ameritrade or Fidelity. This is done on your behalf. They will then modify your existing portfolio to match their recommendations. It is important to know that the monthly cost does not include standard trading commissions. At TD Ameritrade, this is $9.99 per stock/ETF trade and up to $24 per mutual fund trade depending on the fund. AT Fidelity Investments, this is $7.95 per stock/ETF trade and up to $40 per mutual fund trade depending on the fund.

Who should use FutureAdvisor?

Use FutureAdvisor if you are looking for ways to improve your portfolio without going to a professional asset manager. They have a plan for a do-it-yourself person willing to take their recommendations and adjust your portfolio on your own. For those looking for automation, FutureAdvisor is a great option as well, especially if you have accounts spread across a number of different brokerages because they’ll pull it all together on your behalf. If that idea scares you, consider MarketRiders.

More Reviews: