I love the convenience of the plastic card that you can swipe and pay for almost anything, anywhere, including drive thrus. But it’s also a really good way to swipe, swipe, swipe your entire income away. That’s why I started using the free (I love that word!) budgeting services of Mint.com about 4 years ago. It helps me keep track of my spending by uploading and categorizing my transactions automatically and also works as a great budgeting tool. Throughout the month it reminds me and alerts me as often as I want (sometimes TOO often!) when I’ve gone overbudget or forgotten a bill. It’s a really great tool that I have shared with a lot of close friends and family members to help them run their finances instead of having their finances run them.

The Card is Too Easy

Sometimes I get so frustrated with how easy it is to swipe the plastic cards we carry around in our wallet. I used to wish I could work on a “cash only” basis. The plan was to allot at the beginning of the month the amount I was going to spend in each different category of my life. I would put the amount in cash into separate envelopes. Then, during the month, I would use the cash from the envelopes and have a very physical way of seeing how much I had left in the envelope for each category. That way I would not overspend and I would always be living within my means.

After assessing it, the cash in the envelope system was too time consuming and impractical for our family. So I went in search of an online budgeting system that would basically do all that with me and allow me to follow my same goal of living within my means, and to save for bigger goals, like buying a home.

There are Many

After sorting through the dozens of online budgeting tools, I have found two that I have used and I will review them both. (link the YNAB review here) I hope it can help you to use your money in the smartest way possible, thereby allowing you to have money for the things you actually need and want, and not just swiping your card here and there for every material possession you see and convince yourself that you need in that moment.

Need Vs. Want

If you are serious about living by a budget, even if it’s a loose budget, it’s important to know the difference between needs and wants and to practice self-control. A lot of times we justify our purchase by how little it costs. Even if the item is only $1, if you can take a few seconds to think about where that $1 purchase will fit into your budgeted categories then it can help you decide if you really need that item or if it would be better to use that dollar later for something you actually need. A lot of small, unneeded purchases can add up to hundreds and thousands of dollars each year. So be honest in your decisions about needs and wants.

Confession

I don’t love budgeting, and I’ve had to learn and practice hard the principle of forgoing useless wants in order to save for greater wants and needs. I don’t love entering data into spreadsheets and tracking my spending in my check book. That’s why I loved the automatic system that Mint.com uses in pulling all your transactions and categorizing them for you. It saves time and does the mundane tasks for me and lets me be more a “manager” of my money instead of just a “book keeper.”

Is Mint the right tool for you?

Is Mint the right tool for you?

If you can answer “yes” or “probably” to at least 7 of the following 10 questions then Mint.com would be a great tool for you:

1. I want to have more money but don’t want to go get a part time job

2. I would like to set up a budget and tracking system for my finances

3. I wish I could live within my means

4. When I get my credit card or bank statement I often feel surprised at how many purchases I’d made and forgotten about.

5. I don’t have a lot of time to put toward budgeting but I see the value in it

6. I prefer using free services, if they actually offer a good product, instead of paid services

7. It helps me to have reminders to keep me on track with my goals

8. I’m not an accountant and therefore don’t know much about booking journal entries or bookkeeping

9. I would like to use my money for more than just my monthly bills/expenses, ie…to save for a home or a big vacation or for investments

10. I think graphs and charts are a cool way of understanding data

Here is what I love about Mint.com

1. It is SAFE and SECURE which gives you peace of mind because it links to all your account and is updated daily. This is what takes up 90% of the work of budgeting. By using Mint.com, all you have to do is go through and make sure it is categorizing your transactions correctly and fix the few errors it makes and you are done. You don’t have to be bookkeeper and know the intricacies of credits and debits and their different columns. Mint is your bookkeeper.

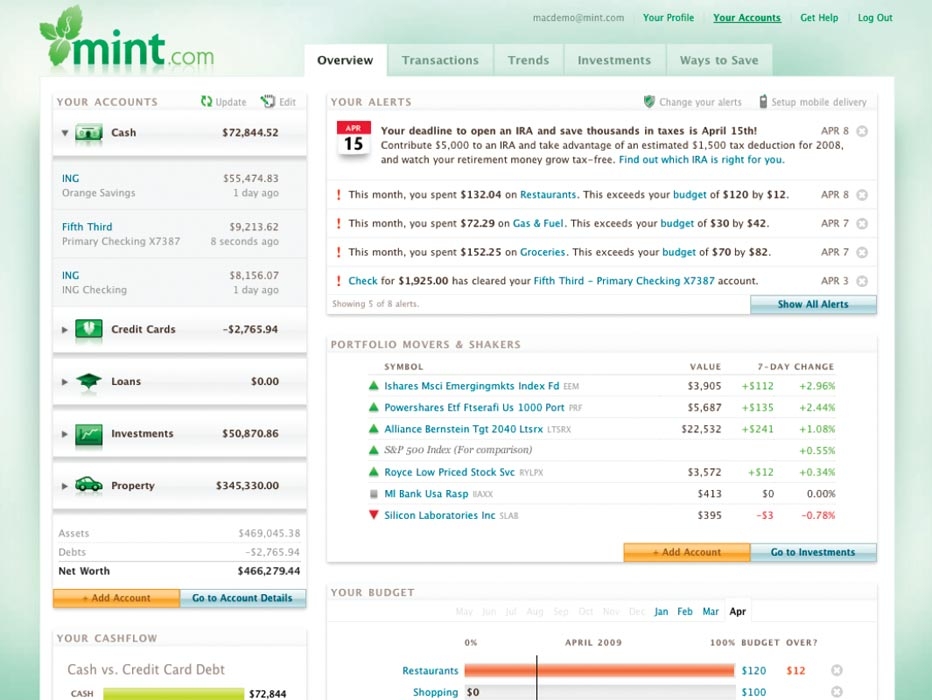

2. It gives you a summary on the front page/Overview tab that shows all the amounts of your different accounts, and it is updated hourly/daily. It will tell you how much cash is in your checking and/or savings account(s), how much you owe on your loans, how your investments are doing, what your transactions for the months are, what your debt is. It also lists your assets and shows you what your net worth is after taking all the above into consideration. It’s a really good overview of your finances all in one place! Just one login name and one password and your whole financial overview is there before you.

3. You can use it’s filters to select how often you would like alerts and what to alert you on. For example, when you’ve gone over budget in a certain area, Mint.com will send you an email. When you’ve been hit with a fee, Mint.com will send you an email. Like I said, it’s like your own, personal bookkeeper keeping track of your money!

4. It categorizes your transactions automatically and also allows you to overwrite any allocation to make sure all your expenditures are categorized correctly, thus giving you the most accurate overview of your finances.

4. It categorizes your transactions automatically and also allows you to overwrite any allocation to make sure all your expenditures are categorized correctly, thus giving you the most accurate overview of your finances.

5. You can use it as a budgeting tool and also a tracking tool. While it’s important to know where your money is spent, it’s also important to set rules for yourself on how you are going to spend your money. That’s where the budgeting tool is handy. Although most of us don’t like budgets, they are like any rules; they protect us. In this case, they are protecting us from ourselves and our overspending! The budgeting tab/tool is very user friendly and easy to customize to fit your exact needs.

Still not convinced you’ll love Mint? Well, here are some more things to get excited about…

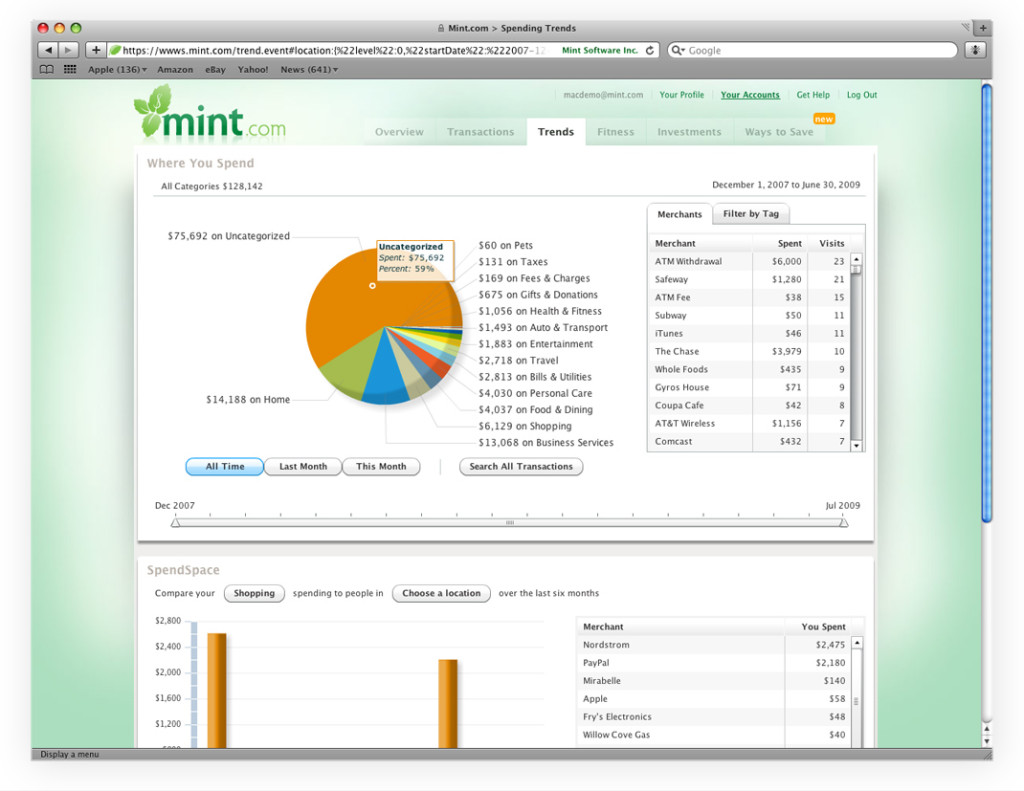

1. It uses cool, interactive graphs and charts that help you see, in a fun and useful way, exactly where you stand. For example, one chart gives you an overview of your spending and breaks it down into categories. You can then click on any one of the categories in the graph and it will show you each transaction that contributed to that amount. Very easy to use and you can even create your own charts based on the data available.

2. It helps you keep track of your upcoming bills that are synched to the site, ie, credit cards, loans, etc. It can send you an email telling you that you have an upcoming bill due.

3. You can use it for long term savings goals; ie…for a home, for travel, for rainy day fund. It helps you determine what you can afford and what smaller goals to set along the way to reach your larger goals. It will tell you if you’ve gotten off track! It will walk you through each smaller step in order to reach your larger goals, such as purchasing a home.

4. It helps you learn more about investing and understanding that using your money for enjoyment is better than just using it to pay your bills. It recommends services such as

5. It has free mobile apps so you can even access it on the go

The Best Thing:

You don’t have to be an accountant or familiar with booking journal entrie s in order to run your personal finances and track your expenses. Mint.com does it for you. While it is true that you can get an account and start getting set up within minutes, you should expect it to take a few hours to get all your accounts linked to the site, depending on how many accounts, assets, credit cards, loans etc. that you have. And it will take some weekly diligence in the first few months and then regular checking in thereafter to make sure your transactions are being categorized correctly. But it’s really a low maintenance budgeting and tracking system, which is really nice during busy times or if budgeting and finance aren’t your passions!

Tools of the Trade

Because it a financial tool, the operators are tapped into the market and they offer a lot of great tools you can use besides the budgeting and tracking tools. Mint.com can help you

1. Find ways to save, ie…through accounts and credit cards that offer the best rewards

2. Know if you should rent or buy, using their market indicators

3. Know some great home buying secrets

4. By offering tax tips for first time homebuyers

5. Understand home loans

6. Understand interest rates

Of course, it’s not perfect

The biggest flaws are in the budgeting and goal setting tools. It is not as customizable as other, more labor intensive budgeting software/websites. For instance, if you have $5000 you owe on a credit card that you plan to pay off in three months from now when you get your bonus, but you can only pay a minimum payment of $100/month for the next two months, the goal tool does not allow you to break it up and set future payment plans. It calculates your goal based on what you are paying on it now and sets a projected goal met date based on that.

More Serious Budgeting software

The best thing about mint.com is that it is for those of us who are busy and who are not financial experts but still want to track our spending and live on a budget. But since it’s budgeting tool isn’t as in depth and customizable as other budgeting software, it might not be the right thing for you if that is what you are seeking.

Getting an account and setting up your account are two different matters. Plan on it feeling a bit time consuming for the first month or two. That is usually the part that scares most people off. “I don’t have the time to budget” they say. But they want more money. So maybe they consider getting a part time job. That would bring in more money, but in the end I guarantee they won’t feel like they have more money. Instead, if they learn to budget, save and invest their money it will be like the money is working the part time job instead.

Getting an account and setting up your account are two different matters. Plan on it feeling a bit time consuming for the first month or two. That is usually the part that scares most people off. “I don’t have the time to budget” they say. But they want more money. So maybe they consider getting a part time job. That would bring in more money, but in the end I guarantee they won’t feel like they have more money. Instead, if they learn to budget, save and invest their money it will be like the money is working the part time job instead. Rainy Days

Rainy Days