Jempstep Review

Executive Summary

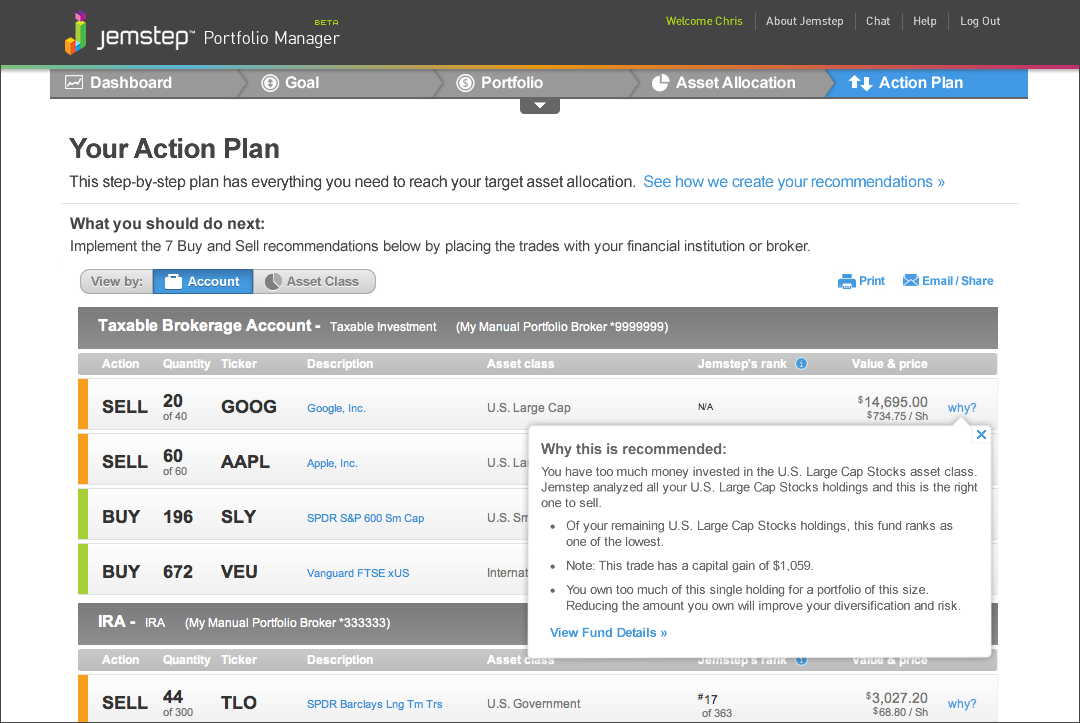

Jemstep provides the ordinary investor with the steps needed to help you create the ideal portfolio based on your personal and financial profile and appetite for risk. It analyzes your current investments and provides an investment plan that factors in tax consequences and fees then keeps you on target by notifying you when to rebalance your portfolio. Use it to aggregate and analyze your current portfolio against an optimal portfolio or to start a great retirement plan.

Jemstep Pricing Structure and Fees

Jemstep has a free basic plan and a flat-fee premium plan. This is one of the best aspects of Jemstep because it will significantly lower your investment management costs.

The free services will include portfolio monitoring, retirement progress, target allocation, and four buy/sell recommendations.

The premium service will also include a personalized action plan, real-time monitoring, instant alerts based on market changes, and quarterly rebalancing recommendations. Premium pricing starts at $17.99/mo for portfolios valued between $25,000 and $150,000.

| $0 – $25,000 | $25,000 – $150,000 | $150,000 – $300,000 | $300,000 – $600,000 | $600,000 and Above |

|---|---|---|---|---|

| Free | $17.99 / month | $29.99 / month | $49.99 / month | $69.99 / month |

Understanding the Jemstep Portfolio Manager

Jemstep recommends a portfolio for you, but allows you to use the same broker that you already have. They do not make trades on your behalf like Wealthfront and they do not take over active management of you portfolio like Personal Capital. It is however a feature they may add in the future per their website, which states, “Jemstep does not currently offer the ability to automatically execute trades on your behalf using Jemstep Portfolio Manager although it is a capability we are exploring.” Their product is geared toward someone who wants to maintain some of the control over their portfolio, but may not have the time or ability to create a risk adjusted portfolio on their own.

Jemstep uses patented technology to create the maximize returns at an acceptable  level of risk. The software uses principles of Modern Portfolio Theory to produce a balanced, risk-adjusted portfolio and then helps the investor rebalance to maintain that risk adjusted portfolio. The software makes recommendations of ETFs and Mutual Funds based on an analysis of 20,000 funds. In theory this means you will end up with the lowest cost and best return based on your risk profile.

level of risk. The software uses principles of Modern Portfolio Theory to produce a balanced, risk-adjusted portfolio and then helps the investor rebalance to maintain that risk adjusted portfolio. The software makes recommendations of ETFs and Mutual Funds based on an analysis of 20,000 funds. In theory this means you will end up with the lowest cost and best return based on your risk profile.

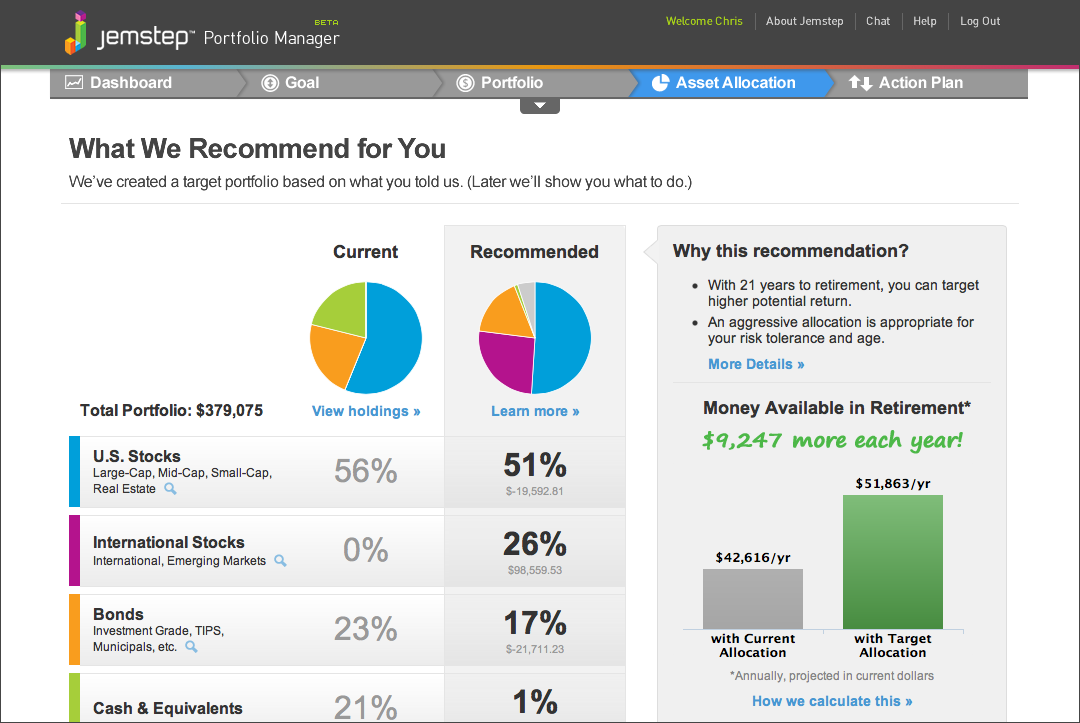

Getting Started on JemStep

Signing up for JemStep was easy and very clean. I’ve had to manually upload account balances with other online personal finance software, but I had no problems with Jemstep. There is a brief survey that requests age, marital status, income, and risk tolerance. It took less than five minutes. I was then asked to upload my current retirement accounts and my accounts linked quickly and correctly. I did not have to make any manual entries. Jemstep’s software then compared my current holdings and a recommended portfolio. Apparently my age and risk profile would allow me to be more aggressive.

My 401k seems to be a problem for JemStep because I had the assets in a target fund that the system cannot recognize. As such, it recommended that I change it to specific asset classes. The recommendation is very simple, “Buy the lowest cost U.S. Large Cap Stocks fund in this account.” 401k accounts typically are a problem for online personal finance software. Unless there is an arrangement between the provider of the 401k and the advisor company, the software can’t see what funds are available and cannot make a specific recommendation. In an effort to circumvent the problem and help you move to Jemstep’s recommended portfolio, they make the following offer, “If you email the list of funds available in your 401k to help@jemstep.com, Jemstep will soon add specific recommendations to your 401k account.” It’s a simple solution.

After making the recommended portfolio adjustments, Jemstep takes you to your retirement dashboard where you can see the current status of your portfolio. The dashboard summarizes your your accounts, your profile, your asset allocation, and any actions that you need to take going forward.

After making the recommended portfolio adjustments, Jemstep takes you to your retirement dashboard where you can see the current status of your portfolio. The dashboard summarizes your your accounts, your profile, your asset allocation, and any actions that you need to take going forward.

The premium version of the software will review my asset mix every three months and make recommendations to bring the portfolio back in line with the target allocation.

Last Word on Jemstep Portfolio Manager

On the whole, I enjoyed the Jemstep experience. The recommendations seem to be in line with accepted best practices and the people have been very helpful in assisting me through the process as needed. The everyday investor will find Jemstep to be a helpful tool in combining different accounts and adjusting their target allocations to get her portfolio to an acceptable risk level.

If I could make any changes it would be to shine more light on what the software is doing as it is processing my inputs because it would instill a bit more trust and understanding of what is going on behind the scenes. Nothing too obtrusive would be necessary but the system currently zips through a list that is completed so quickly that I wasn’t sure what was going on. I’d also like to see relationships developed with providers of 401k plans that would allow Jemstep to know what the T Rowe Price 2040 Target Fund really contains. That’s easier said than done because T. Rowe Price may not be too keen on a company like Jemstep taking some of their thunder.

A few links to check out related to Jemstep:

Jemstep’s Knowledge Base is a good place to ask questions and search for answers.

Is Jemstep safe? Here’s their answer.

Other Jemstep Reviews:

MarketWatch likes it.

mymoneyblog.com has a review with some great comments from Jemstep’s CEO.