Is infinite banking a scam? If you consider permanent life insurance to be a scam, then it’s a scam. I don’t, but I know that some do.

While I don’t think it’s a scam, it can feel that way for a few reasons, not least of which is the pushy salespeople.

The Be Your Own Banker, Infinite Banking, and Bank On Yourself methodologies have been around for a long time because they are whole life insurance policies marketed as financing and banking tools. The real question to ask is whether you should purchase permanent life insurance. Generally, you should simply purchase term insurance.

Permanent life insurance should not be your first “investment” and is best suited for those looking for additional ways to pass money to their heirs or for those who need permanent insurance due to age. It’s an estate planning tool or a way to get life insurance if you are past the age where term insurance is a viable option. Be Your Own Banker / Infinite Banking looks to turn permanent life insurance into a retirement plan and perhaps a means of financing major purchases. I recently sat through a series of meetings with a Be Your Own Banker life insurance broker to understand what it is all about and if I could use it to finance a major purchase that would require a bank loan.

The basic concept in Infinite Banking is that you would fund a whole life insurance policy and use the cash value of the policy purchase permanent life insurance and tack on a paid up additions rider. This allows you to borrow against the cash value of the policy. In theory you could then pay off your car loan or use it to finance your business. As a financing vehicle it could potentially be cheaper than getting a loan from a bank. As an investment vehicle, studies show that you are better off putting your money into a balanced portfolio. If you’re not sure how to create one of those on your own check out Personal Capital or MarketRiders and they’ll do it for you. A risk adjusted portfolio will have better returns over time.

I ultimately decided not to purchase the product primarily due to the high up-front cost of purchasing whole life insurance, the 7% fee that would be scraped off the top of my investment, and my personal confidence in earning a return equal to the compound average growth rate of 9.3% by investing in the market.

The counter-argument was that to achieve that tax savings, the lower fees, and guaranteed returns achieved by purchasing whole life insurance were a safer and better investment. One of the main components of achieving that return was the purchase of a paid up additions rider. By adding that rider, the cash value of the policy increases, allowing for better returns.

Major Selling Points

1. Forced savings plan

2. Guaranteed returns

3. Secure financial institutions

4. Interest free loan

5. Tax free withdrawals

Major Drawbacks of Infinite Banking / Permanent Life Insurance

1. Cost – Here’s where I balked. The initial cost is quite prohibitive and the money injected was not accessible for a number of years. Perhaps if the returns were better over time it would’ve been easier to take the bitter pill.

2. Forgoing High Returns in the market. While I understand the calculation, I believe that by investing in a low cost 401k plan with a diversified mix of assets that are rebalanced over time, I can still out perform the projected permanent life insurance.

The returns were our main disagreement. I argued that the average return generated by stocks is about 10% since 1928. The salesman said that we should use the most recent 30 years of data. This actually took the returns higher, but we brought it back down by layering on a crippling management fee of 3.0%. Fees average between 1% and 2% on 401k plans so the 3% was overstated.

The Be Your Own Banker concept (is trademarked!) will appeal to people who do not want any risk. They’d rather have a fixed return, even if it is potentially lower than what is available on average from the market. Purveyors of the Be Your Own Bank concept run through a series of calculations with you to “prove” that you’re better off putting your money into permanent life insurance than into your 401k. And in many cases they are right. There are a lot of people who do a very poor job of managing their finances. They end up in a 401k with high fees and the wrong asset mix for their age and risk tolerance. In turn, this creates a financial tsunami that buries them when they need their money most!

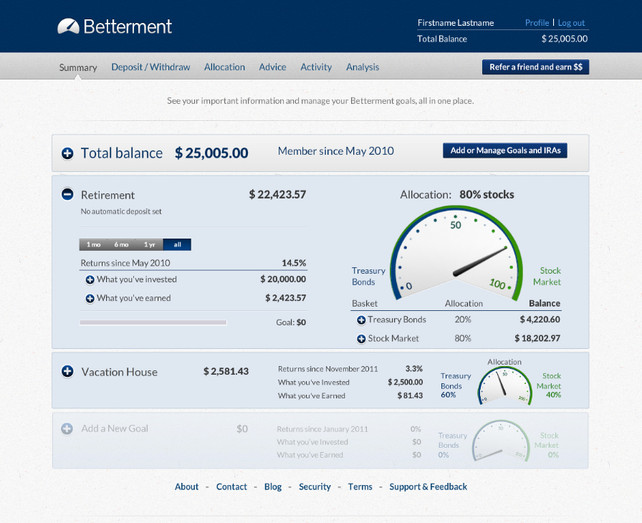

I had a generally positive experience with the salesman. We disagreed but he was not disagreeable. I can see this concept appealing to some people but would not recommend it unless market risk puts you into a catatonic state or you simply will not ever save unless forced into it. Know that this is not a true savings account and your money is not immediately available. Instead of going with permanent life insurance, embrace some risk and you will see higher returns. Be confident that you are not throwing your money away by putting into your 401k. The life insurance industry calls this strategy, buying term and investing the difference. It’s a good strategy. Automate your savings and work towards specific investing goals (Betterment style investing). You’ll achieve them and end up with higher returns in the long run.

There’s a great discussion over at the White Coat Investor site. The good stuff is in the comments.