So what is Wikinvest? How does it work? Should you use it? Let’s see if we can answer your questions.

On a basic level, Wikinvest is a portfolio tracking service. In reality it is a portfolio tracking service, an investment advisory service, and an investment analysis resource. As the number of portfolio tracking apps increases, Wikinvest maintains its foothold as the very best.Wikinvest has the ability to combine accounts from 25 major brokerages and provide real-time updates of your accounts. The power to combine your accounts into a single view provides powerful analytical opportunities. If, like me, you have jumped companies a few times, you potentially have a 401k with Vanguard, a Roth IRA at T. Rowe Price, a day trading account with E*Trade, and an old account at another brokerage that you opened 10 years ago. Wikinvest will not only allow you to combine them, but within a minute you will have an update on all of your accounts. Their mobile app is also the best available bar none.

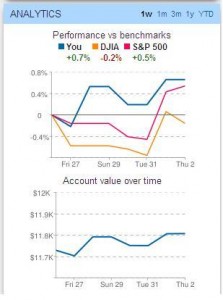

What I have found to be valuable is the portfolio insights that help me identify hidden fees and the true performance of my portfolio. While the Internet has brought a lot of accessibility, it has not always made life easier. Wikinvest makes life easier for those who are looking to quickly track stocks across a large number of portfolios. Simple insights and a clean intuitive view make it a great product.

I also like the ease of use. I was able to add three accounts in less than a minute. This has a lot to due with the nature Wikinvest. You are not investing through them. They do not hold your money and they do not authorize trades. Because the service is to conglomerate, they have established relationships with brokerage houses to give them read-only access. One the website, they call it “fail-safe.” It says, “Wikinvest’s portfolio tracker is read-only; you can’t transfer money into or out of your brokerage account using our system.” Despite the fact that you can’t transfer money using their system, they still provide 256 bit SSL encryption for all data and physical servers are kept safe as well.

Who will really benefit from Wikinvest? Well, if you are an active investor who wants visibility of multiple accounts and relationships, Wikinvest will provide that for you. You will also benefit from Wikinvest if you have a financial planner whom you wish to monitor and track. Have your planner load your information to Wikinvest so that you can receive real-time updates of your position. Don’t use the service as a way to get back at your planner as much as a way to monitor and track the progress of your investments over time.

Who will not benefit from Wikinvest? Well, the reality is that even a small player can gain some benefits from Wikinvest. I previously tracked my investment accounts on Mint.com but have never been satisfied with the reports and aggregation of brokerage accounts. They seem to run into more problems that Wikinvest so I plan to keep both. One will provide me with an accurate gauge of my overall financial position and spending habits, while the other will give me updates on my investment portfolio in a clear and insightful manner.

I trust the security more with Wikinvest as well because it requires less information knowing that it is a read only format. Other aggregation services have me enter usernames, passwords, and security questions. I feel uneasy with that level of disclosure. Wikinvest takes that disclosure out of the picture.

Wikinvest also takes crowdsourcing to a new level by empowering users to add notes to stocks that include investment analysis and

notes telling users to buy or sell certain stocks. The site divides investments into various asset classes and then invites users to participate in the analysis of the company. Top contributors get their names next to the company stock, essentially creating an open source investment management service. You can read reasons why people are bullish or bearish on the stock, see what trends others are highlighting and then head to your broker to take action on the analysis.

The Internet provides a lot of noise, especially in the personal financial software arena. Wikinvest provides quiet clarity by leveraging the knowledge of many and allowing the wisdom of crowds to dictate instead of the wisdom of an individual. It’s investment analysis for the Internet generation.

UPDATE

Wikinvest will be phased out. SigFig replaces Wikinvest. See my review here.