Betterment Review

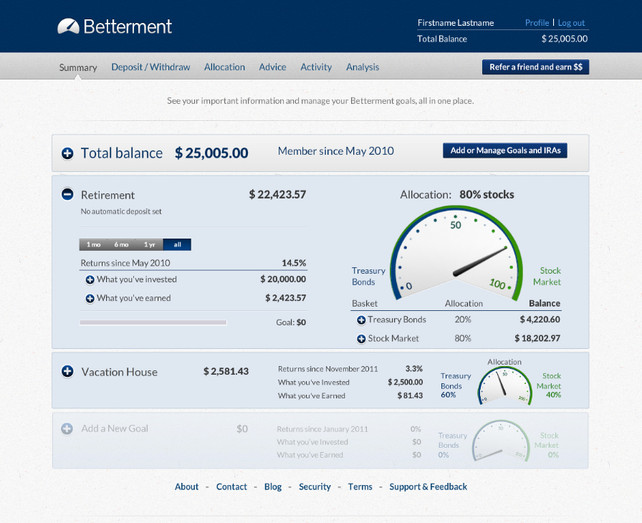

Betterment.com is a great fit for people who need a clear plan and some motivation. I really like the goal based investment plan. It allows you to allocate your money in a way that makes sense for your needs. It is clear to the user how they are progressing and because they segregate the cash into different tranches, you mentally separate the dollars as well. Betterment’s automatic savings plan is a great feature because automation is one of the keys to growing your nest egg. For some people, socking money away on a regular basis is as easy and natural as breathing. For most people, we tend to live closer to the edge of our income than we are comfortable doing, but don’t know how to get out of the cycle. As a college student you hear about investing and dream that someday when you are in your dream job you will be earning enough money to have extra to use for investments. How quickly those dreams vaporize as you are hit with the expenses of inflation, taxes, and the reality of just how expensive life is. That is why an investment program like Betterment.com is helpful. Betterment helps you save for life’s major financial hurdles by providing you with a goal oriented investment plan. It’s so easy. The best part of a service like Betterment is first, it is easy to use. It takes about 10 minutes to get an account. The majority of their clients are not financial advisors and they have developed their product to be easy enough to be used by just about anyone. Second, it helps you ease into investing with a low monthly deposit, gets you out of the cycle of spending every dollar you earn and uses it to help you achieve your financial goals and protect you for your future through sound investments.

What are you investing in? Although it’s an automated program, you are involved in what you are investing in based on the way you define your asset allocation when you start your account. And you don’t have to be a financial advisor to make good investment choices. Betterment has done the market research already and has put together a varied portfolio of stocks and bond. Here are some investments they offer: (the ticker is in the parenthesis)  Stock Portfolio Makeup

Stock Portfolio Makeup

- 25% Vanguard Total Stock Market ETF (VTI)

- 25% iShares S&P 500 Value Index ETF (IVE)

- 25% Vanguard Europe Pacific ETF (VEA)

- 10% Vanguard Emerging Markets ETF (VWO)

- 8% iShares Russell Midcap Value Index ETF (IWS)

- 7% iShares Russell 2000 Value Index ETF (IWN)

Bond Portfolio Makeup

These choices all follow their respective index very closely and are very liquid, which lowers the bid/ask spread. They are also tax efficient, and offer low annual fees. In other words, you can feel secure in what you are investing in because Betterment has done the background work and only offer the best investment options for their clients. Of course, nothing in investing is a guarantee. There is always some risk in investing. But where there is no risk there is no reward. Why ETFs? You will notice that the above portfolio is full of Exchange Traded Funds (ETFs). That’s because they are more liquid and easier to trade and very cheap. It’s like buying a stock of a bunch of tiny pieces of stock which helps you diversify in a very quick and easy way. And being diversified is one of the biggest keys in investing. It’s also one of the hardest things for anyone besides a financial advisor or someone who closes watches the market to do because it takes a lot of research. You don’t want all of your eggs in one basket. With ETFs you get a little bit of a lot of different stocks.

Aren’t we all a little afraid of how to handle our money? Because of the ups and downs in the economy, banking industry, real estate industry and the stock market over the past 20 years, many people are afraid of investing and just end up keeping their money in their savings account. Some credit unions and banks will even pay you a small interest rate to bank with them, but there is usually a cap on what they are willing to pay you. While savings accounts and credit unions definitely have their place in the market, they are not the best way to build a large savings account, nor will they be able to pay you the highest return on your monthly deposits. “Over the long-term, investing in the stock market tends to outperform money in a traditional bank savings account.”

Watch it Grow With Betterment, your money is always accessible to you if you need to withdraw it at any time and there is no penalty to do so. Better yet, hopefully you won’t need to withdraw your money, as you are trying to achieve certain financial goals, and you will be able to sit back and watch over the years as the dividends you’ve earned are automatically reinvested to keep earning you money.

How Much Does Betterment Cost?

You’ll pay between 0.15% – 0.35% as a management fee. There is no minimum investment amount and no minimum balance requirement, but if you cannot invest at least $100/month, you will pay a $3/month fee. They really want to make investing easy and accessible to everyone. They offer a free 3o day trial period and 3 plans to choose from. You get to decide where you fit in and pick the plan that fits your lifestyle the best. And here are the plans they offer: 1.The Builder Plan: If you are in the beginning stages of trying to build your savings/investments, the builder plan is as easy as depositing $100 and being done with it. You can break up the $100 in to as many smaller increments that you need to in order to reach that amount, but the monthly total must be $100. You can even use direct deposit to accomplish this and forget about it entirely, while all the while your money is being saved, invested, and used better than it would if you had it on your bank statement, just waiting to be spent. The annual fee is .35% As noted above, if you cannot commit to $100 a month then you will be upgraded to the Better Plan. And if you don’t have the $10,000 required for that plan, you will pay a $3 monthly fee in place of the annual fee. 2. The Better Plan: At a lower annual fee of .25%, the Better Plan requires a $10,000 investing minimal balance, but the monthly deposit is optional. Better yet, “the $10,000 minimum is across all of your Betterment goals, including IRAs.” This plan also carries with it the next day deposit benefit, which means that your money will be invested within 24 hours of originating a transfer, as long as the market is open. 3. The Best Plan: This is for those people who have at least $100,000 to invest. Of course, the annual fee is the lowest for this plan, at .15% and it also has the most “perks”, including: optional monthly deposit, next day deposit, a personal consultation and also trust accounts. While Betterment does not charge hidden fees, their management fee does not include fees associated with the funds that you choose. However, the management fee does cover transaction fees, trading fees, transfers, rebalances, advice, and account administration. Betterment is an SEC Registered Investment Advisor. Betterment purchases your selected portfolio through Betterment Securities, which is a registered broker-dealer. While your deposit is not safe from market fluctuations, you are protected by SIPC up to $500,000. So if you aren’t interested in hiring a financial advisor or going through endless hours of research on your own to become your own financial advisor but want to start investing, Betterment.com is a really great option. It’s easy to use and very intuitive.

How Could Betterment Improve? I keep waiting for another Personal Financial Management company to combine investing and expense tracking like Personal Capital. I’d like to see Betterment combine my accounts and then provide advice based on the whole picture. For now, you could combine Betterment with SigFig to get a picture of your combined portfolio. You’ll like the clean look and goal based investing. Tracking investments inside the system is easy and if this is your first foray into investing, Betterment is a great choice. You can sign up for Betterment by clicking here.

I want to bring this to the attention of clients of betterment that betterment charges a fee up to $400 if you want to do a direct (in-kind) transfer from betterment to another brokerage. I have been trying to do a direct transfer of Roth IRA from betterment to another brokerage firm and was quoted this amount.

This fee is also listed in their customer agreement in section 23. Please be aware that your only option could be an indirect roll over if you don’t want to pay $400 in transfer fees.

Betterment does not openly advertise this fee, which I think they must do when they list any or all fees on their website.

Thanks for the heads-up. That’s a hefty fee to get your money transferred.

Hi F@B,

Katherine from Betterment here. Thanks for the comment. As I posted in response to you on a few other blogs, you are correct, there is a fee that would be assessed should a 3rd party direct transfer be requested. This is because it would involve a 3rd party to complete the action – it is not a feature provided with your account. Betterment will NOT charge any transaction fees to allow you to complete an indirect transfer of your account, and is our recommended method.

While we apologize that the new brokerage may charge fees for the trades of moving funds into your account as cash, we do our best to provide an option that does not cost anything extra.

Thanks,

Katherine

Hi Katherine,

Can you help me understand the difference between a direct and an indirect transfer?

The direct transfer involves transferring custody from Betterment to a different brokerage. What is the indirect transfer?

Matt